The Patient Investors

At Nightingale Partners, we specialise in providing patient expansion capital to middle and lower-middle market companies. We generate superior investment returns by taking a long term perspective and following a disciplined and structured approach.

With experience across a vast range of industries, we have built an enviable network of investments, business leaders and advisors which help our investee companies reach their potential.

By leveraging our network and combining focused business strategy, disciplined capital management and rigorous execution, we ensure our investments provide superior long-term returns for all stakeholders.

Investment Approach

Established as an open-ended investment vehicle with a flexible investment mandate, Nightingale Partners invests in a wide range of industries. As genuinely patient investors, our investments are long-term, aiming to work with management to grow their business to a stage where they can stand alone successfully. Taking minority stakes in businesses, we support quality management through financial and operating discipline, strategic thinking and investment.

Our investments have traditionally been in established, privately owned companies that are identified to contain strong management, excellent growth prospects and the need for equity to expand their operations. Our private equity portfolio includes investments in engineering, services, manufacturing, energy and the athleisure apparel industries.

We also allocate a portion of our portfolio to more aggressive early stage companies including investments in the B2B software, fin-tech, virtual reality, medical technology, and smart cities verticals.

Our History

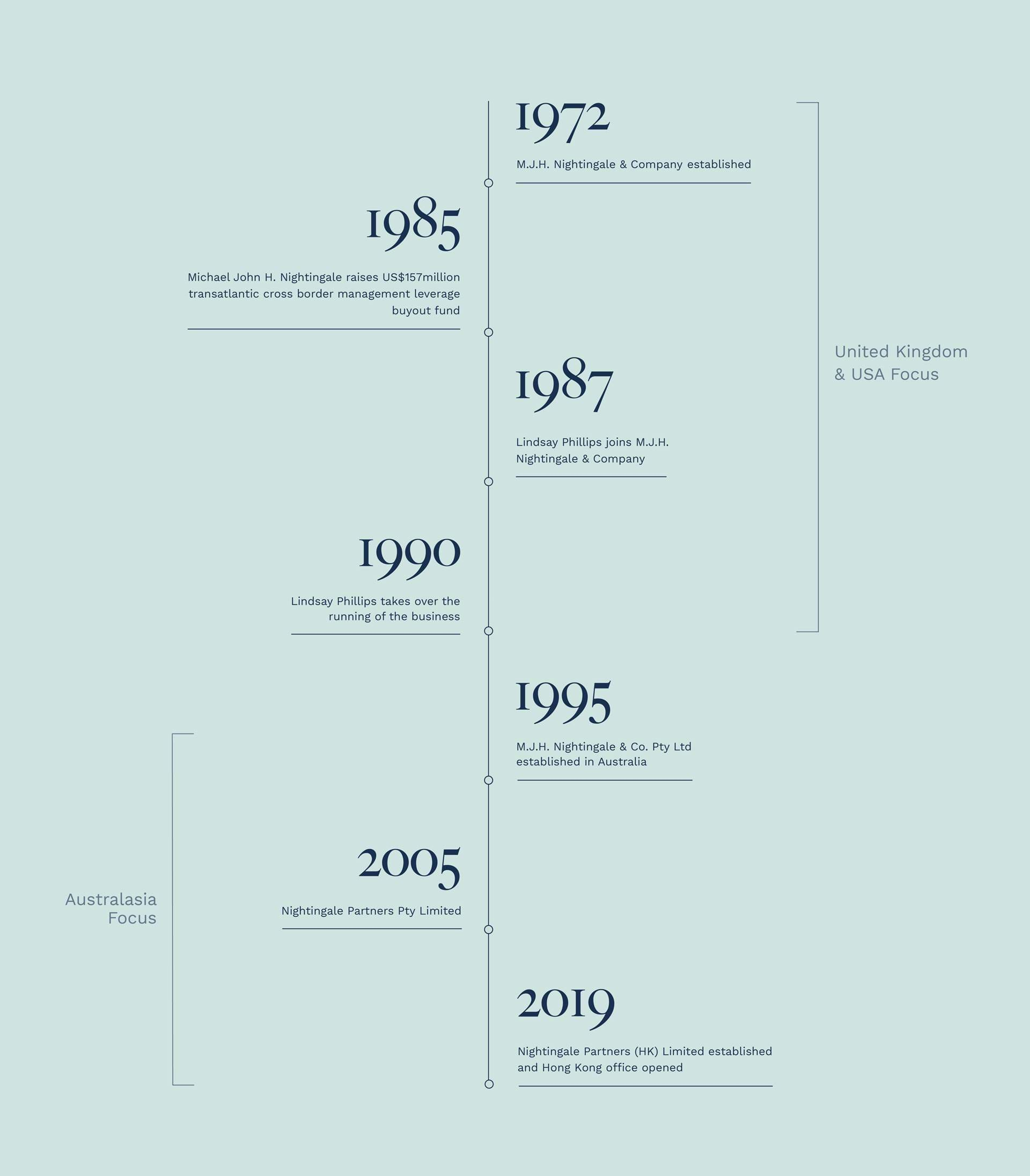

At Nightingale Partners we have a rich history dating back to London in the 1970s when Michael Nightingale established his company M. J. H. Nightingale & Co to create an ‘over the counter’ market by securing finance for and acquiring shares in small companies not traded on the London Stock Exchange.

In 1985/6, Michael Nightingale raised a US$157 million transatlantic cross-border management buyout fund – Nightingale Atlantic Partners LLP.

In 1987, Nightingale’s current chairman, Lindsay Phillips, joined M.J.H. Nightingale & Co before taking over the running of the business in 1990 following the passing of Michael Nightingale. Upon his return to Australia in 1995, Lindsay established M.J.H. Nightingale & Co. Pty Ltd and in 2005 set up Nightingale Partners Pty Limited. In 2019 Nightingale Partners (HK) Limited was established and a new office was opened in Hong Kong.